How to Write a Business Check to Yourself 2025

In 2025, writing a business check to yourself is a simple yet powerful way to access your business funds. Whether you’re a small business owner or a freelancer, this process can help you manage cash flow, reimburse yourself for business expenses, or even take a draw from your business account.(business financial management)

But if you’re unsure how to properly write a business check to yourself, don’t worry. This guide will walk you through everything you need to know, from understanding the mechanics of business checks to ensuring you’re following best practices for bookkeeping and tax purposes.(writing a business check)

Writing a business check to yourself might seem a bit unconventional, but it’s a common practice for various reasons—whether you’re managing cash flow, reimbursing yourself for business expenses, or paying yourself a salary. This guide will walk you through the process in a clear, step-by-step manner, ensuring you do it correctly and avoid any potential pitfalls.(How to Write a Business Check to Yourself 2025)

Why Write a Business Check to Yourself?

Before we dive into the details, let’s briefly cover why you might need to write a business check to yourself:

Reimburse Expenses: If you’ve paid for business expenses out of your personal funds, you might need to write a check to yourself to reimburse those costs.

Pay Yourself: As a business owner, especially if you’re a sole proprietor or partner, you might write a check to yourself as a way to draw a salary or distribution from the business.

Cash Flow Management: Sometimes, writing a check to yourself can help manage cash flow by transferring funds from your business account to a personal account.(How to Write a Business Check to Yourself 2025)

Step-by-Step Guide to Writing a Business Check to Yourself

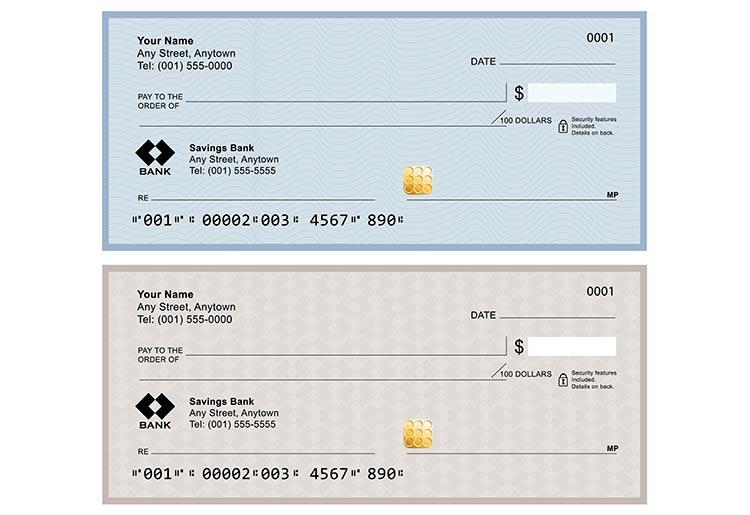

Gather Your Materials

Before you start, make sure you have:

A business checkbook

A pen (preferably with blue or black ink)

Your business checkbook register (if applicable)

Fill in the Date

On the top right corner of the check, you’ll see a space for the date. Write the current date or the date you want the check to be effective. This is crucial for record-keeping and ensuring the check is processed at the correct time.

Write Your Name on the Payee Line

In the “Pay to the Order of” line, which is typically located on the left side of the check, write your name. This is where you specify who the check is intended for—in this case, yourself. If your business operates under a different legal entity (like an LLC or corporation), write your name as it appears on your business documents.(How to Write a Business Check to Yourself 2025)

Enter the Amount in Numeric Form

In the small box next to the “Pay to the Order of” line, write the amount of money you want to withdraw from your business account. Be precise and ensure the numbers are clear. For example, if you’re writing a check for $500.00, write “500.00.”

Enter the Amount in Words

On the line below the payee’s name, write out the amount in words. This helps prevent any confusion or alterations. For instance, if you’re withdrawing $500.00, write “Five hundred dollars and 00/100.” Make sure to draw a line after the words to prevent anyone from adding extra numbers.(How to Write a Business Check to Yourself 2025)

Write a Memo (Optional)

In the “Memo” or “For” line at the bottom left of the check, you can write a brief note about the purpose of the check. This could be something like “Expense Reimbursement” or “Owner’s Salary.” While this step is optional, it helps with record-keeping and tracking the purpose of the transaction.

Sign the Check

Sign the check on the line at the bottom right. Use the same name as it appears on the “Pay to the Order of” line. Your signature is essential as it authorizes the check and verifies its legitimacy.

Record the Transaction

Make an entry in your business checkbook register or accounting system. Note the date, check number, payee (your name), amount, and purpose of the check. This step is crucial for maintaining accurate financial records and ensuring your business accounts balance correctly.(How to Write a Business Check to Yourself 2025)

Deposit or Cash the Check

Decide whether you want to deposit the check into your personal account or cash it. If you’re depositing, take it to your bank or use mobile banking features. If you choose to cash it, visit a bank branch. Be aware that some banks might require additional identification or have specific policies for cashing checks from business accounts.

Important Considerations – Write a Business Check to Yourself

Business Structure: If your business is a corporation or LLC, ensure you follow proper protocols for drawing money, as there might be specific rules or regulations to adhere to.

Tax Implications: Writing checks to yourself can have tax implications. Be sure to consult with a tax professional to understand how this impacts your taxes and financial reporting.

Record-Keeping: Maintain meticulous records of all transactions to avoid any issues with audits or financial discrepancies.

FAQ: Common Questions About Writing Business Checks to Yourself

Can I write a business check to myself if my business is a corporation?

- Yes, business owners of corporations can write checks to themselves, but the process differs slightly depending on the business structure. For corporations, it’s essential to follow the guidelines for paying yourself, which may include taking a salary rather than just withdrawing funds.

Do I need to pay taxes when writing a business check to myself?

- Yes, when you take a draw from your business, it’s subject to taxes. As an owner, you’re responsible for paying self-employment taxes on the income you withdraw from your business.

How to Write a Business Check to Yourself 2025

Writing a business check to yourself is a straightforward process but requires attention to detail. By following these steps, you ensure that your transactions are accurate, transparent, and properly documented. Whether you’re reimbursing yourself, drawing a salary, or managing cash flow, handling business checks with care helps maintain the integrity of your financial records and supports the smooth operation of your business. (How to Write a Business Check to Yourself 2025)